Fomc Statement / Fomc Statement After Fed Votes To Taper Marketwatch

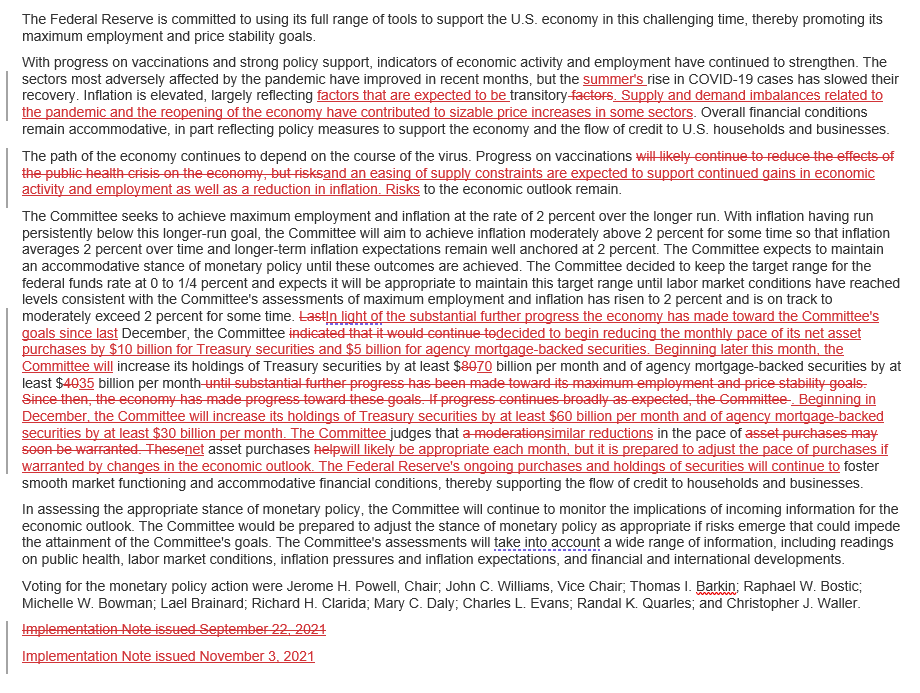

The November 3rd Federal Open Market Committee FOMC statement will be closely scrutinized. If progress continues broadly as expected the Committee judges that a moderation in.

Fomc Fed Meetings 2021 S Big Forex Market Events

The FOMC meeting for November began today and will conclude tomorrow.

Fomc statement. Read FOMC September statement Last Updated. 3 2021 at 210 pm. Economy in this challenging time thereby promoting its maximum employment and price stability goals.

For release at 200 pm. The Federal Reserve is committed to using its full range of tools to support the US. Fed raises inflation forecast and for the first time.

The FOMC holds eight regularly scheduled meetings during the year and other meetings as needed. The Fed FOMC statement after Fed votes to taper Last Updated. The Federal Reserve is committed to using its full range of tools to support the US.

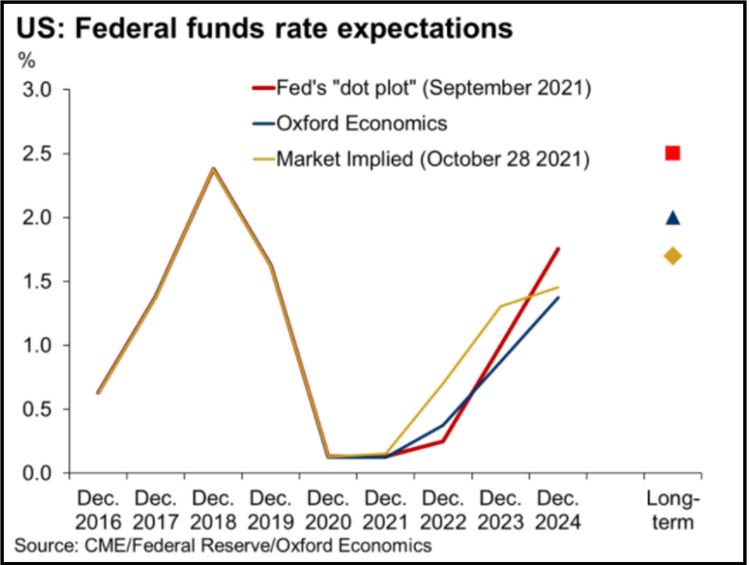

Economic Assessment The economic assessment was little changed. The FOMC statement said the US. They will focus intently on the most recent Federal Reserve policy statement and the newly updated interest rate projections vis-à-vis.

Information received since the Federal Open Market Committee met in August indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. For release at 200 pm. FOMC statement November 3 2021 The Federal Reserve is committed to using its full range of tools to support the US.

The Federal Reserve is committed to using its full range of tools to support the US. The Board of Governors of the Federal Reserve System voted unanimously to maintain the interest rate paid on required and excess reserve balances at 010 percent effective January 28 2021. EST on June 16 2021 and the response of the markets in the immediate aftermath has been muted.

Economy continues to recover from the pandemic but the rise in Covid cases has slowed the recovery. June 2021 Following the Feds announcement find our latest market views from the Global Fixed Income Currency Commodities GFICC US. Part 2 Following another month of jobs and inflation data we revisit our last blog Sugar High and reflect on the recent price action in the US rates markets.

With progress on vaccinations and strong policy support indicators of economic activity and employment have continued to strengthen. The statement also said a US. Federal Reserve issues FOMC statement.

Federal Reserve issues FOMC statement. Market participants investors and traders are waiting for the conclusion of the September FOMC meeting tomorrow. The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world.

Statement on January 27 2021. Outlook The Fed continues to view the path of the economy as dependent. The statement said that a tapering of the central banks bond-buying program quantitative easing is on the table for discussion.

22 2021 at 210 pm. Karen Pierog Reuters Published. The statement will contain information about when the Federal Reserve will begin tapering their 120 billion monthly asset purchases.

Treasury yields were mostly higher in. The Committee maintained an optimistic tone on the recovery while recognizing that the increase in COVID-19 cases has slowed the recovery. 22 2021 at 205 pm.

July 2021 Following the Feds announcement find our latest market views from the Global Fixed Income Currency Commodities GFICC US. Economy in this challenging time thereby promoting its maximum employment and. Links to policy statements and minutes are in the calendars below.

The minutes of regularly scheduled meetings are released three weeks after the date of the policy decision. FOIA The FOMC makes an. The sectors most adversely affected by the pandemic.

The FOMC continues to view inflation as elevated due to transitory factors. Job gains have been strong on average in recent months and the unemployment rate has stayed low. Economy in this challenging time thereby promoting its maximum employment and price stability goals.

The reason the Fed will likely raise key interest rates. Economy in this challenging time thereby promoting its maximum employment and price stability goals. Wall Street expects guidance on both tapering its 120 billion per month in quantitative easing as well as its dot plot of forecasted interest rate increases in 2022.

Rate hike is likely in 2022. At the end of the Feds two-day meeting the governors voted unanimously to keep the fed funds upper target at 025 where it has been since last March and to. Nov 3 2021 1127AM EDT.

Most importantly it will be the statement and following press conference by Chairman Powell that will draw the most attention. TREASURIES-Yields rise ahead of FOMC statement. June 16 2021 at 208 pm.

The Fed said the 2021 inflation forecast is 42 and that inflation. Federal Reserve issues FOMC statement. FOMC statement highlights from the Sept 22 2021 release.

Tomorrows FOMC Statement. The FOMC statement was released at 200 pm. As part of its policy decision the Federal Open Market Committee voted to authorize and direct the Open Market Desk at the Federal Reserve Bank of New York until.

Committee membership changes at the first regularly scheduled meeting of the year. FOMC statement for June Published. For release at 200 pm.

Part 2 Following another month of jobs and inflation data we revisit our last blog Sugar High and reflect on the recent price action in the US rates markets. The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. 3 2021 at 208 pm.

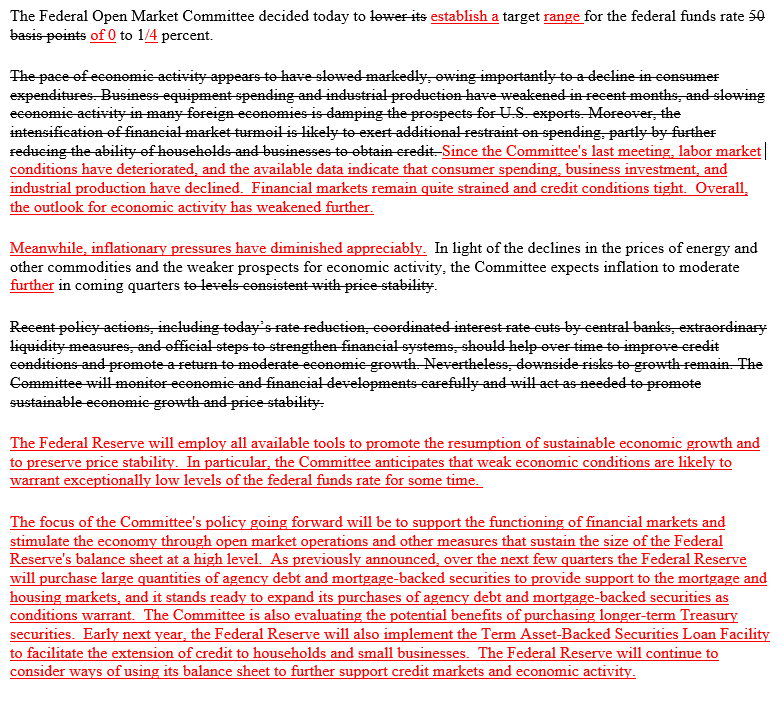

How To Read An Fomc Statement St Louis Fed

3 Things To Know Before Trading The Fomc Statement May Babypips Com

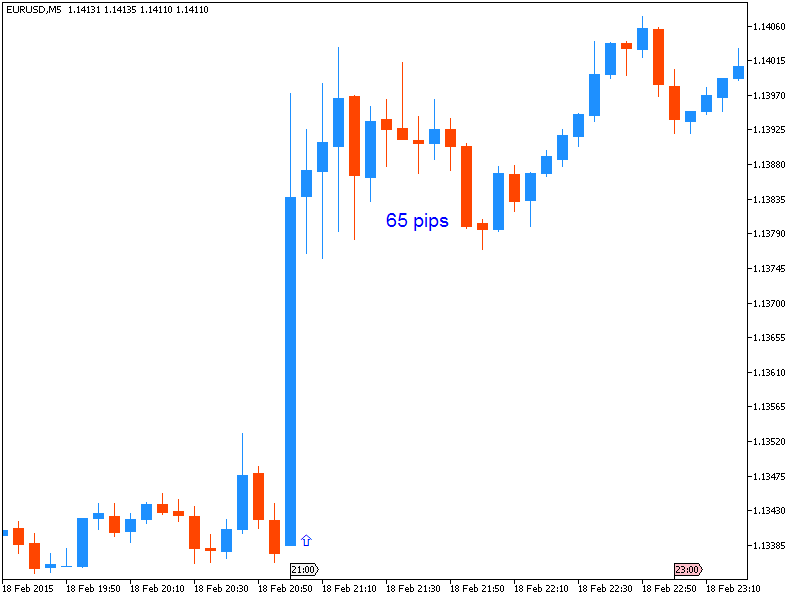

Fomc Meeting Minutes Reactions From 10 Major Banks Trading Systems 20 February 2015 Traders Blogs

Federal Reserve To Support Us Economy Issues Fomc Statement Caribbean News Global

Fomc Statement After Fed Votes To Taper Marketwatch

Fed Holds Policy Slight Hawkish Tweak To Fomc Statement

This Is Probably A Rare Fomc Meeting Where The Minutes Matter More Than The Statement

Fomc Statement Tonight Fed Holding The Cards Of Tapering Close To The Chest Errante

Federal Reserve Issues Fomc Statement The Industry Spread

Frb Feds Notes Hanging On Every Word Semantic Analysis Of The Fomc S Postmeeting Statement

3 Takeaways From The February Fomc Statement Babypips Com

Daily F X Analysis October 07 Top Trade Setups In Forex Fomc Meeting Minutes Ahead Forex Academy

Wednesday 2nd May Fomc Statement Eyed Today Fed Expected To Stand Pat On Policy Ic Markets Official Blog